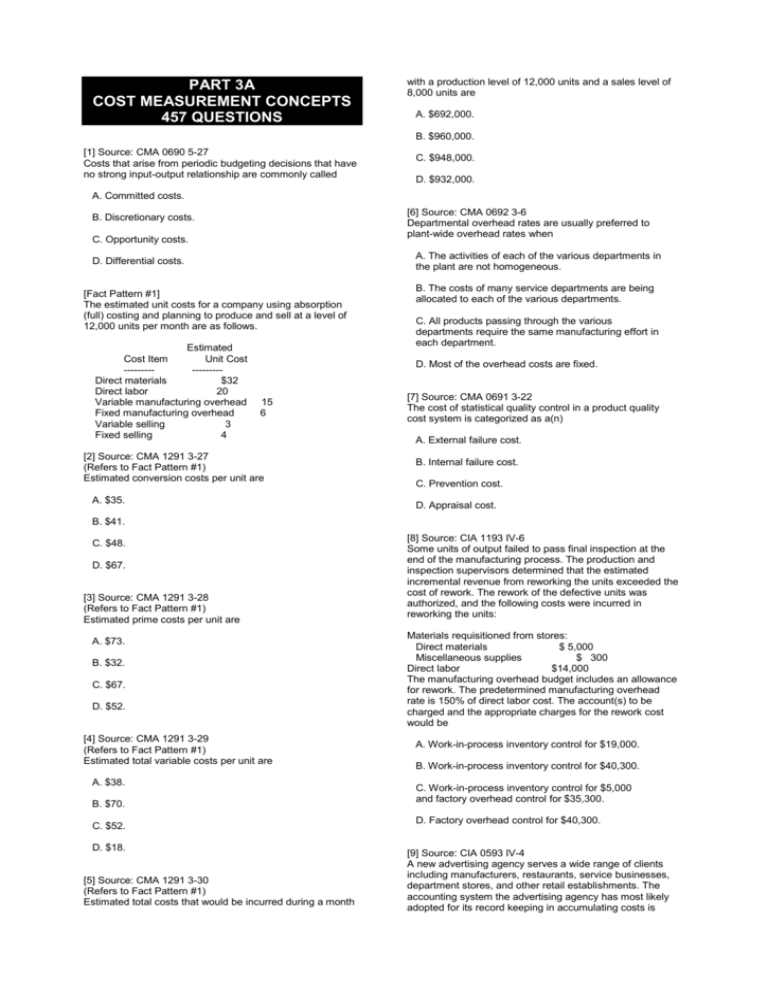

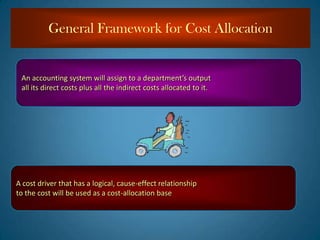

Regardless of the System Used in Departmental Cost Analysis:

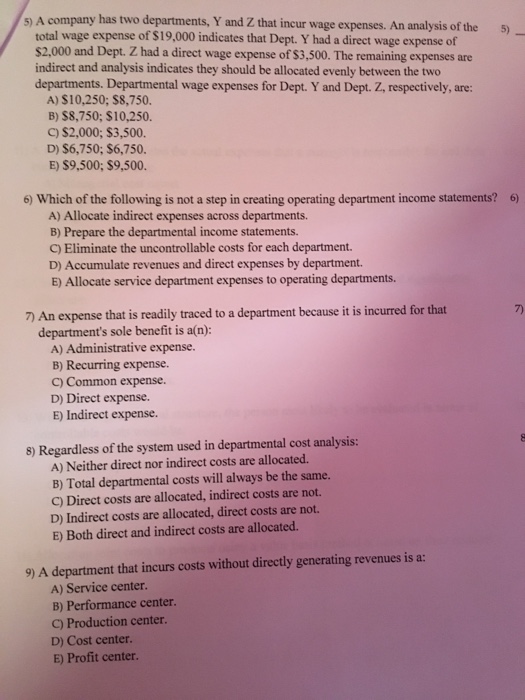

The image below compares the cost per unit using the different cost systems and shows how different the costs can be depending on the method used. It shows the cost objects that take up most of the costs and helps determine if the departments or products are profitable enough to justify the costs allocated.

Ch 23 Quiz Docx An Out Of Pocket Cost Requires A Future Outlay Of Cash And Is Relevant For Current And Future Decision Making True False The Decision Course Hero

The cost assessment was based on 6-month standardization of observed cost data.

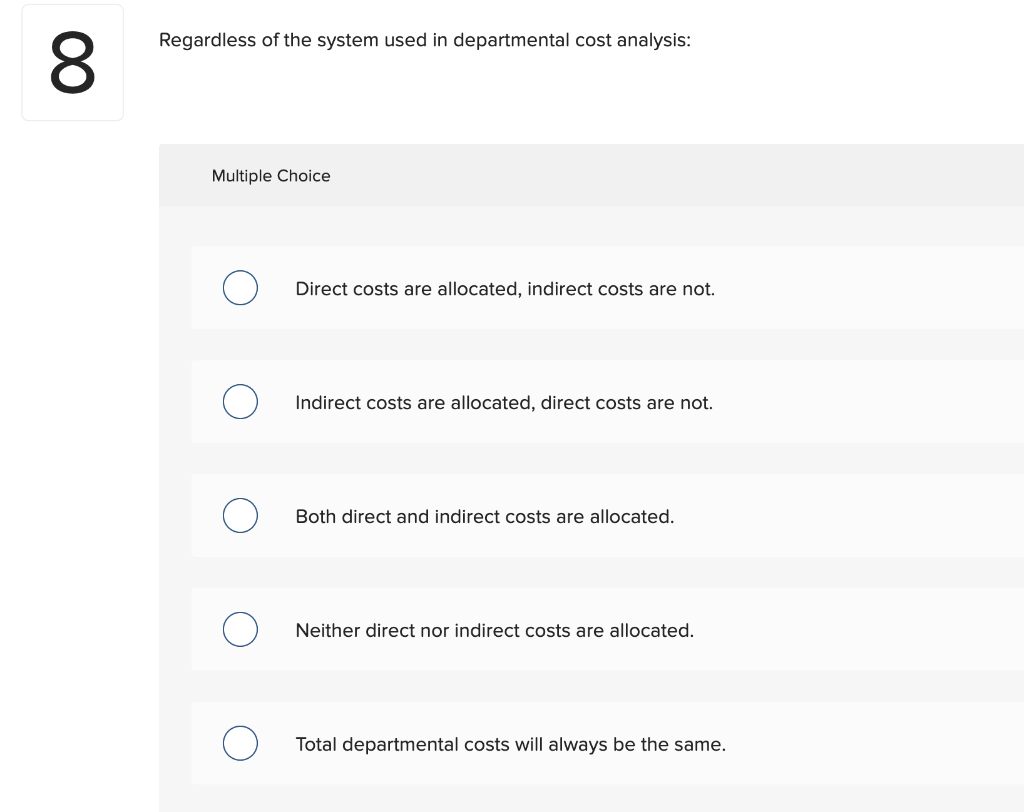

. Both direct and indirect costs are allocated. C Both direct and indirect costs are allocated. Regardless of the system used in departmental cost analysis.

Neither direct nor indirect costs are allocated. Regardless of the system used In departmental cost analysis. Regardless of the system used in departmental cost analysis.

Indirect costs are allocated direct costs are not. 36 Compare and Contrast Traditional and Activity-Based Costing Systems. Direct costs are allocated indirect costs are not.

Direct costs are allocated indirect costs are not. Indirect costs are allocated direct costs are not. In the mid-19th century Dupuit used basic concepts of what later became known as cost benefit analysis in determining tolls for a bridge project on which he was working.

Both systems will be capitalized and amortized using a CCA rate of 10. Cost accounting lets you collect data from various sources such as the general ledger sub-ledgers budgets and statistical information. Regardless of the system used in departmental cost analysis.

Indirect costs are allocated direct costs are not. For example knowing the cost to produce a unit of product affects not only how a business budgets to manufacture that product but it is often the starting point in determining. A Direct costs are allocated indirect costs are not.

Both direct and indirect costs are allocated. B Indirect costs are allocated direct costs are not. Neither direct nor indirect costs are allocated.

Multiple Cholce Total departmental costs will always be the same. Both direct and indirect costs are allocated. You can then analyze summarize and evaluate cost data so that management can make the best possible decisions for price updates budgets cost control and so on.

The source data that is used for cost. System A will incur development costs of 175500. It can be concluded then that the cost and subsequent gross loss for each units sales provide a more accurate picture than the overall cost and gross profit under the traditional method.

Indirect costs are allocated direct costs are not. The proposed capital project calls for the Manufacturing Department to fully automate a production facility using one of two different advanced robotics systems. Indirect costs are allocated direct costs are not.

Calculating an accurate manufacturing cost for each product is a vital piece of information for a companys decision-making. Total departmental costs will always be the same. Both direct and indirect costs are allocated.

Regardless of the system used in departmental cost analysis the indirect costs are allocated while direct costs are not. Total departmental costs will always be the same. System B will cost 650000 to develop.

Total departmental costs will always be the same. Direct costs are allocated indirect costs are not. Neither direct nor indirect costs are allocated.

Regardless of the system used in departmental cost analysis. Regardless of the system used in departmental cost analysis. For unprofitable cost objects the companys management can cut the costs allocated and divert.

Total departmental costs will always be the same. Direct costs are allocated indirect costs are not. Indirect costs are allocated direct costs are not.

Regardless of the system used in departmental cost analysis. Both direct and indirect costs are allocated. An accounting system that provides information that management can use to evaluate the profitability andor cost effectiveness of a departments activities is a.

E Total departmental costs will be the same. Neither direct nor indirect costs are allocated. The amount by which a departments sales exceed its direct expenses is.

Neither direct nor indirect costs are allocated. Total departmental costs will always be the same. Regardless of the system used in departmental cost analysis.

Indirect costs are allocated direct costs are not. Direct costs are allocated indirect costs are not. Regardless of the system used in departmental cost analysis.

Indirect costs are allocated direct costs are not. The earliest evidence of the use of cost benefit analysis in business is associated with a French engineer Jules Dupuit who was also a self-taught economist. Total departmental costs will always be the same.

Direct costs are allocated indirect costs are not. The model-based comparative cost-effectiveness analyses were conducted with system-specific assumptions of the effect size and costs in scenarios with consumptions of 15000 30000 and 45000 doses per 6-month period. Both direct and indirect costs are allocated.

D Neither direct nor indirect costs are allocated. Regardless of the system used in departmental cost analysis. Regardless of the system used in departmental cost analysis.

Neither direct nor indirect costs are allocated. Cost allocation provides the management with important data about cost utilization that they can use in making decisions. Indirect costs are allocated direct costs are not.

Direct costs are allocated indirect costs are not. Direct costs are allocated indirect costs are not. In a practical sense direct costs.

Multiple Choice Direct costs are allocated indirect costs are not. Both direct and indirect costs are allocated. Neither direct nor indirect costs are allocated.

Solved The Following Information Was Available For A Company Chegg Com

Solved A Company Has Two Departments Y And Z That Incur Chegg Com

No comments for "Regardless of the System Used in Departmental Cost Analysis:"

Post a Comment